Greek debt crisis: Is Grexit inevitable?

By Paul KirbyBBC News

Greeks are now limited to taking out a maximum

of €60 in cash per day from the banks

of €60 in cash per day from the banks

Greek debt crisis

Greek banks have been closed and strict limits placed on cash withdrawals after the prime minister called a 5 July referendum that some say could propel Greece out of the euro.

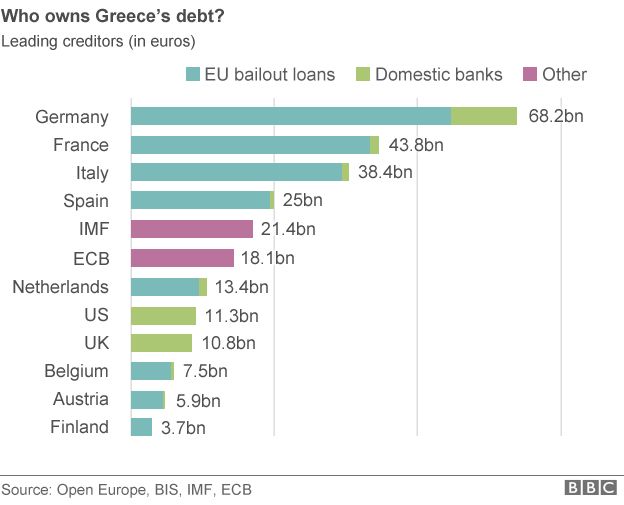

Months of negotiations on extending Greece's cash-for-reforms deal with the eurozone have collapsed, so the Greek bailout ran out on 30 June and Alexis Tsipras's government failed to make a key debt repayment to the IMF of €1.5bn ($1.7bn; £1.06bn).

The European Central Bank (ECB) has said it won't extend emergency funding for the banks and there is a growing risk of Greece lurching out of the single currency - which has come to be known as Grexit.

Why is Greece in danger of leaving the euro?

Although Prime Minister Alexis Tsipras disagrees, several European leaders have warned that a "No" vote in Sunday's referendum on a bailout deal with the eurozone would spell an end to Greece's participation in the single currency.

Greece's last cash injection from international creditors was back in August 2014, so the Athens government desperately needs a new lifeline.

That lifeline is in trouble. The five-year eurozone bailout that had been keeping the Greek economy afloat expired on 30 June. And, on the same day, Greece became the first developed economy to miss an IMF payment. Technically, the IMF says Greece is "in arrears" and will not declare it in default for some time.

But it was the ECB's decision on 28 June to freeze its €89bn emergency cash programme of keeping the banks running on 28 June (Emergency Liquidity Assistance) that prompted Greece's capital controls and cash crisis.

Without a eurozone deal to resolve the impasse, its future in the euro is looking bleak.

-----------------------------------------------------------

Kommentar:

Administrator

THE OTIUM POST

No comments:

Post a Comment

Enter your comments here: